BRIGHT IDEAS

4 MIN READ

Canadians + PayBright = A Modern Valentine’s Day Shopping Romance

by

Samantha Mehra

February 12, 2021

Gone are the days of wilting rose bouquets and after-thought chocolates.

As recently as last year, Canadians have increasingly levelled up their gift-giving game for Valentine’s Day. And, according to PayBright data, instead of investing in the tired items of the past, they’re opting to buy now and pay later for premium products that are more fun, functional, and/or longer-lasting than freshly-cut flowers.

How are Canadians using PayBright as part of their buying behaviours around the season of love? Who is shopping most, where, and in what categories for Valentine’s Day? To answer these questions and help merchants better prepare for the next round of romance-by-retail, we took a closer look at consumer purchasing activity from seasons of love past.

Read on to learn more about the most popular BNPL-enabled verticals and brands when it comes to Valentine’s Day gift shopping, and the age groups that are loving it the most.

Top 5 PayBright Valentine’s Day Verticals

In 2020, Canadians chose to pay over time for Valentine’s Day gifts that offer either more fun or more functionality than a fleeting romantic dinner or a hastily-enjoyed sweet treat. 45% of PayBright contracts occured in the consumer electronics space, followed by furniture and furnishings at 12%, and non-surgical cosmetic treatments at 6%.

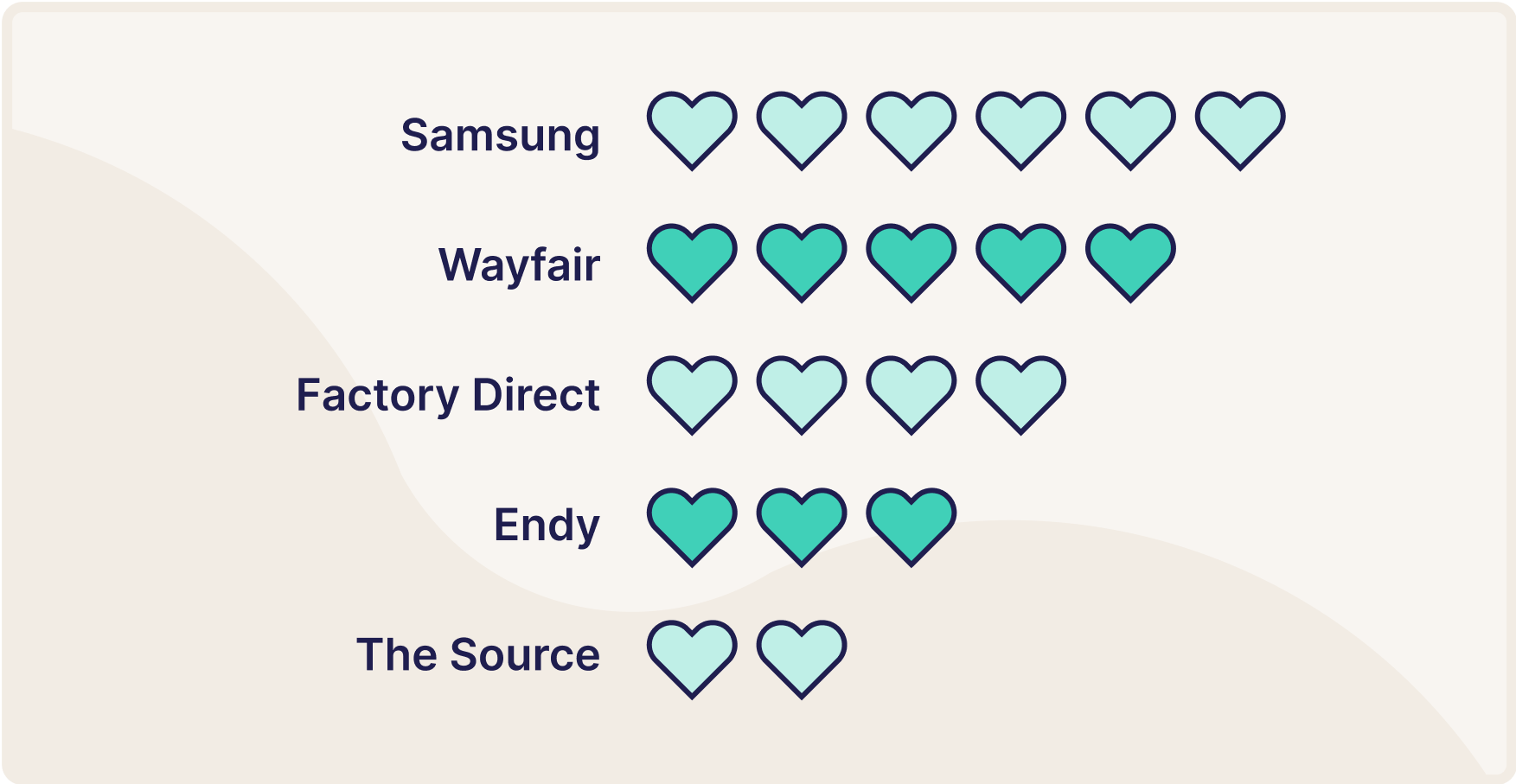

Canadians’ Favourite BNPL Brands on Valentine’s Day

Related to the above popular shopping categories, Canadians showed particular love for the following brands when powering their Valentine’s Day purchases with PayBright:

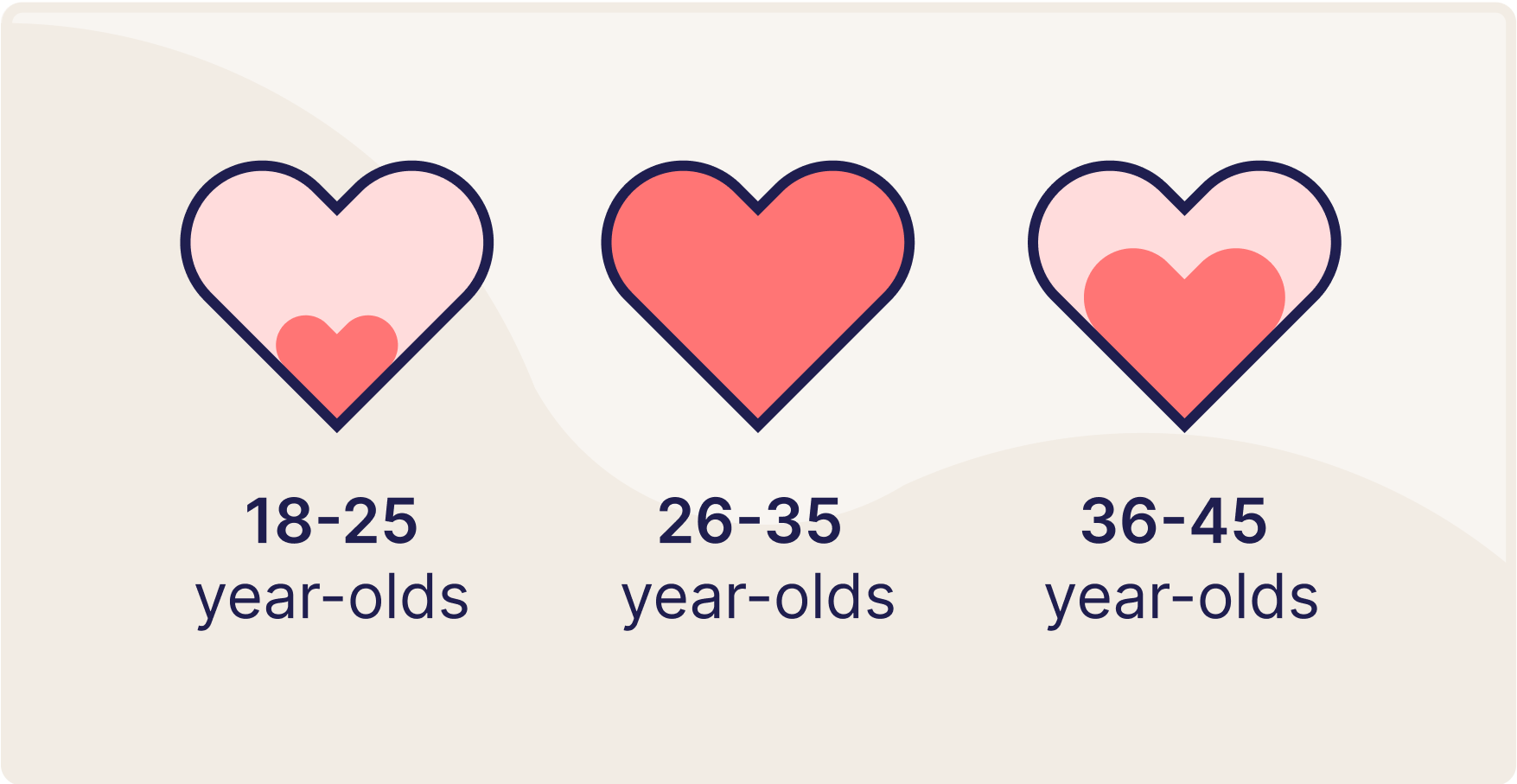

Buy Now, Pay Later: Which Age Groups Love it Most for Valentine’s Day Shopping?

Even though PayBright’s BNPL payment plans are a need and expectation across all age groups, it’s of increased popularity in the week leading up to and including Valentine’s Day for particular generations. 32% of PayBright purchases made in that time period were the work of 26- to 35- year-olds, with 36- to 45-year-olds coming in a close second at 25%.

And for 2021, given that buying ‘experiences’ is now even more limited during COVID, we’re fairly certain that these buying behaviours, and the age groups accelerating them, will continue in the lead-up to Valentine’s Day in 2021.

Need more Valentine’s Day Intel? New 2021 Report Reveals “Hidden Costs of Relationships”

If you need more Valentine’s Day intel for 2021, fear not: international buy now, pay later provider Affirm recently launched a revealing report on how modern consumers approach Valentine’s Day, and their perceptions of buying behaviour (and finances in general) in preparation for the holiday.

Some key finance-focused findings from the report include:

- Nearly seven in 10 prefer to alternate who pays for a date when actively dating someone; on average, respondents think couples should start alternating the bill after three dates.

- 63% agree that if one person makes more money than the other, they should pick up the bill for most dates.

- Overall, consumers suspect that their ex romantic partners owe them an average of $170.

- More than half (57%) think badly of an ex because they owed them money before the relationship ended.

Given that many plan to spend a healthy amount in an effort to make their loved ones feel love on Valentine’s Day, “it’s not surprising that more than half (53%) of respondents are interested in using a buy now pay later solution to buy their gifts,” said Silvija Martincevic, Chief Commercial Officer at Affirm. “Affirm provides consumers the ability to pay at their own pace! With no fine print and no late fees, consumers will never pay more than they expect, making this the perfect solution for everyday and special occasion purchases."

Read the recent release to learn more about the survey’s fascinating results.

- Based on # of contracts for the period between February 7-14, 2020

This article is provided for informational purposes only. It is not an exhaustive review of this topic. The content is not financial or investment advice. No professional relationship of any kind is formed between you and PayBright. While we have obtained or compiled this information from sources we believe to be reliable, we cannot and do not guarantee its accuracy. We recommend that you consult your personal finance professional before taking any action related to this information. PayBright is a provider of Buy Now, Pay Later (BNPL) solutions. BNPL providers offer plans with a variety of terms and conditions, including interest rates, fees, and penalties, and have different standards for qualifying for loans. Laws and regulations governing BNPL providers vary by jurisdiction. We recommend that you compare and contrast plans, read the fine print, and conduct detailed research into any BNPL provider before using their services.

Share this article

Never miss a story

Brighten your inbox with Talking Shop news!